Diamonds might be your best friend, but they’re not your most prudent investment.

The market is projected to grow from USD 25.89 billion in 2024 to USD 74.45 billion by 2032, exhibiting a CAGR of 14.11% during the forecast period. It is a breathtaking potential increase.

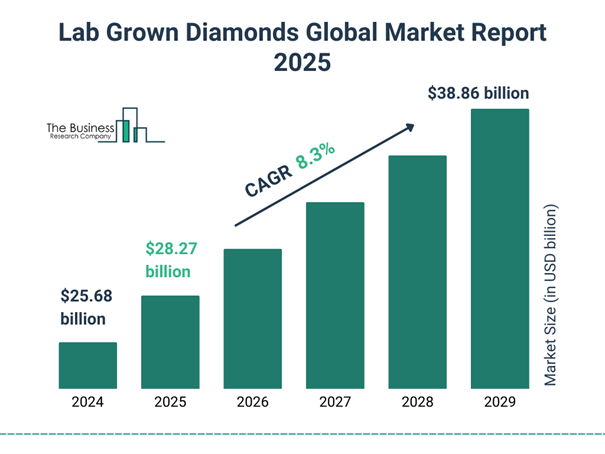

(Source: The Business, Research Company)

They are carving out an increasingly significant place in the diamond market. The trend of synthetic diamonds has become so strong that traditional companies can no longer ignore it. Sales of synthetic diamonds will continue to show double-digit growth annually. Earlier skepticism about synthetic diamonds has now changed, with more people believing they will be the diamonds of the future.

Previously, laboratory diamonds (also known as synthetic or artificial diamonds) were of poor quality. However, thanks to modern technology, artificial diamonds are now chemically, physically, and optically identical to mined diamonds. They are real diamonds, with similar crystal structures, beautiful luster, and the same level of hardness, rated at 10 (the maximum) on the famous Mohs hardness scale.

There are three main reasons for the triumph of laboratory diamonds:

Based on application, the LGD market is classified into industrial and fashion.

The industrial segment has a lead in the market throughout the forecast period. The high use of the product in multiple industries, including electronics, semiconductors, and research, has escalated the segment’s growth. These diamonds are also highly used in various tools and machinery as cutters. The fashion segment will grow at the fastest rate soon. Laboratory-grown diamonds are used in numerous fashion products, including watches, bracelets, and rings. The rapidly growing fashion industry and changing fashion trends are driving the demand for these products worldwide. This jewelry is a more affordable option for middle-income consumers with budget constraints, as its cost is significantly less than mined or natural diamond jewelry

Synthetic diamonds have brought radical changes to the market. As a result, De Beers, the world’s largest diamond trader, was forced to reduce the price of mined diamonds by 40% over the years. This has initiated a price convergence. More buyers are opting for synthetic diamonds because they can get larger or more diamonds at the same price, with the same brilliance and beauty as mined diamonds. LGD prices are falling because their manufacturing costs also keep dropping, while slow demand is pulling down natural diamond prices. This downturn spurred diamond giant De Beers, to cut its rough stone prices by 10% to 15% again at its last December sale.

Some opinions suggest that synthetic diamonds are not competitors to mined diamonds but rather their complement. While people previously bought only one diamond ring, they can now purchase a matching pair of earrings and a pendant for a similar price.

Carat categories

Based on size, the market is divided into up to 2 carats, between 2 and 4 carats, and above 4 carats. The up to 2-carat segment holds the largest market share owing to the lower prices of diamonds. Wedding and engagement rings, including up to 2-carat diamonds, are also highly popular among end users as they are easy to wear daily due to their low weight and small size. The between 2 and 4-carat segment holds the second-leading market share. Diamonds between 2 and 4 carat sizes are expensive and highly preferred by high-income consumers. The most significant market for synthetic diamonds is engagement rings, where the growth is most notable. The markets for tennis necklaces and bracelets are also substantial. Moreover, repeat customers can be attracted in this segment, unlike the wedding ring market, where there are no repeat buyers.

Asia Pacific dominates the global market, favored by the high manufacturing of quality laboratory grown diamonds in various carats and forms across countries such as China and India. North America held the second largest and constantly increasing market share in 2023. Europe is the third-largest market, market growth is backed by rising sustainability trends across countries such as Germany, France, and Italy.

The major producers of the lab-grown diamonds are coming from China which accounted for 9.3% of supply in 2023, rising to 12.7% in 2024. India is the second biggest manufacturer, 2.9%.

Is it a beneficial investment?

The ratio of natural to artificial diamonds in the U.S. market has now reached parity. A year ago, natural diamonds still held a 60% US market share. The market for synthetic diamonds reached $22 billion in 2022, growing by 38% despite a decrease in the price of synthetic diamonds. Forecasts suggest that the synthetic diamond market will continue to grow at a double-digit rate in the coming years.

Diamonds might be your best friend, but they’re not your most prudent investment. In the past year, gold was the smarter move: the safe-haven asset’s price rose 27% as central banks, and jittery investors snapped it up. Bitcoin – so-called digital gold – also proved shrewd, with a near-vertical 125% rise. Falling demand has chipped away at the price of mined stones, and manufacturing improvements have brought lab-grown prices down too – by 75% since 2020, in fact. However, it is worth noting that neither mined nor artificial diamonds are currently considered a particularly good investment. Apart from a few internationally renowned, unique diamonds, their value depreciates significantly after purchase and only slowly regains it over the long term. Therefore, buyers should choose a diamond they like and want to keep.

The future of the diamond market is bright and promising. The market is projected to grow from USD 25.89 billion in 2024 to USD 74.45 billion by 2032, exhibiting a CAGR of 14.11% during the forecast period. Lab-grown diamonds are gaining an increasing share of the global diamond market each year, with the market share expected to amount to over 21 percent in 2025, can be compared to the ration in 2023, lab-diamonds accounted for 14.3 percent of the worldwide diamond market.